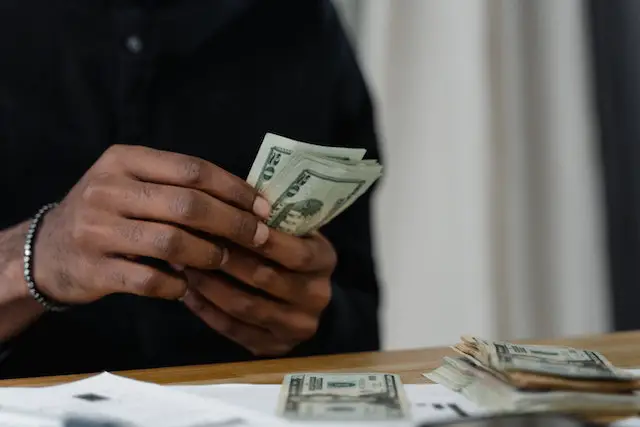

Current Ctc in Salary?

Current CTC refers to the money invested in you by your current firm (where you are now employed) in terms of pay and allowances as indicated above. Expected CTC is the cost to the firm of you, what you expect when joining a new company or requesting a raise at your current employer.

Cost to Company refers to your present package at the organisation where you are now employed, whereas ECTC refers to your future firm’s expected cost to company.

Cost to Company

CTC is the cost that the company bears to keep the employee. It consists of salaries, incentives, pensions, housing, and travel allowances. This figure varies widely by company. Therefore, employees should consider all the components of the CTC before calculating it. Some of these expenses are tax-free. Others are not.

The total cost to the company is usually calculated annually, but it is still an important factor in employee compensation. It is often used as a benchmark for salary negotiations. While it is a valuable tool, it does not always accurately reflect the actual cost of an employee. In addition, this calculation may exempt some expenses, including employee stock options and overtime payments.

Employees should be aware of their costs before accepting a job offer. In addition to the basic salary, employees receive a Dearness Allowance, house rent allowance, special allowance, leave travel allowance, and performance-linked incentives. The CTC also includes other monetary and non-monetary expenses the company incurs in hiring and retaining an employee. Therefore, it is critical to compare the salary and cost to the company.

The Cost of current CTC is the total compensation an employer spends each year on an employee. The costs can be indirect or direct, and they change every year. However, those expenses will determine how much the employee earns in a year if they are constant.

As the foundation for all other allowances, the basic salary forms a significant portion of the CTC. It can be up to 50% of the total salary.

Basic Salary

The Cost To Company (CTC) refers to the total money a company spends on an employee each year, including salary and benefits. While some companies pay a higher CTC, the CTC is usually a constant amount. Therefore, it differs from the bring-home salary, which an employee brings home every month.

Knowing the components of your CTC is essential if you’re negotiating a salary. It will give you a better idea of how much you’re asking for. It can also give you a starting point for negotiation. But, of course, giving an amount aligned with current salary trends is always best.

In addition to your CTC, you will also receive various allowances. These include HRA, conveyance allowance, leave travel allowance, and medical allowance. Some of these are tax-free, while others depend on your actual expenses. Some of these expenses are billed claims such as mobile and medical allowance, which are paid when you submit bills.

You should also know your tax liability. Generally, taxes eat up a large portion of your pay. It would help to consider this when negotiating your CTC with your employer. Be aware that many companies try to get more employee benefits during the negotiation process. For example, if you’re new to the company, you might get a sign-on bonus of about 10% of your CTC.

A CTC measures how much money a company spends on an employee. In many cases, CTC combines the basic salary and various allowances. A CTC will show the total cost of an employee’s salary before any deductions are made. In some cases, CTC is less than enough to provide a decent take-home salary.

Perquisites

The term “perquisites” is generally used to describe the benefits granted to an employee on top of their basic salary and other allowances. They can be both monetary and non-monetary. For example, employees are often entitled to receive a monthly allowance called “Dearness Allowance” (DA) if their gross salary falls below a certain threshold. The government announces the amount of DA each year in its budget.

While the overall CTC for a given position is usually uniform, it may differ depending on the company’s location or size. Therefore, you may want to visit a job board or research the salary range for the position you’re applying for. Also, consider the experience and skill level of the position. Finally, consider any travel requirements or other benefits. Once you know what the expected CTC is, you can negotiate for it.

Another prerequisite often covered by the CTC allowance is the cost of a broadband Internet connection and phone service. The CTC allowance should also cover the cost of health insurance premiums and dental expenses. The CTC allowance should be calculated accordingly based on the needs of the employee and the employer.

The CTC (current total compensation) comprises the basic salary plus other allowances. These allowances can be fully taxable or partially taxable. Depending on the type of perquisites, they can add up to more than 40% of your monthly salary. For example, a bank may subsidize a loan for an employee, adding the difference between the market rate and the subsidized rate to the CTC. The employee pays no interest on the subsidized rate.

In addition to the CTC, the employee may receive a pension. This can be a lump sum payment or an annual payment. A pension is not considered a prerequisite, but a portion of it is included in the employee’s salary.

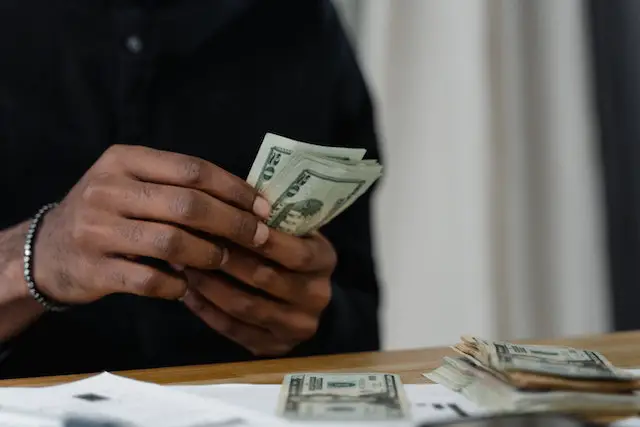

Performance Bonus

A performance bonus is a cash payment to a worker to meet a specific goal. Typically, the bonus amount is smaller than the employee’s take-home pay. Although bonuses are an excellent incentive for employees, they should be separate from their regular pay. This way, the bonus will remind the employee of their efforts and drive them to perform better on the job.

The use of performance bonuses has become a common practice in many organizations. The statistics behind them are compelling: giving employees a 1% raise increases the quality of work by 2%. When this increase is coupled with a lump-sum bonus tied to exceptional contributions, the quality of job performance increases by 20%. The benefits are numerous.

Performance bonuses can be difficult to set. Several factors go into determining the level of a performance bonus. The first is the time employees have to work toward achieving their goals. Having a deadline of at least a year is critical. Otherwise, the employee may not work towards achieving their goals.

Another factor to consider is how the bonus is calculated. Some companies give bonuses based on individual results, while others give bonuses to the entire department or team. For example, a technician may earn a bonus based on the number of parts produced, while a sales representative may receive a bonus based on the number of sales.

Performance bonuses are a great way to increase earnings. Performance bonuses are paid out as lump sums or as a percentage of the regular salary. A bonus gives employees an extra incentive to meet or surpass company expectations.

Taxable Components

There are several taxable components in an employee’s salary. These include the basic salary, bonus, leave encashment, pension, internet reimbursements, and gratuities. The amount of each component varies depending on the employer and the industry in which the employee works. Therefore, each component has a separate tax status; understanding them will help you plan your taxes accordingly.

The basic salary is fully taxable. The higher the basic salary, the more tax an employee will have to pay. However, a low basic salary is not a good idea as it puts the employee at risk of falling below minimum wage standards. In addition, non-cash benefits are taxable. These can include company cars, phones, and internet services. Bonuses, which are given to employees as a lump sum, are a taxable component of an employee’s salary. Bonuses are generally based on the employee’s performance or overall company performance.

Other taxable components include health plan contributions, employee contributions to qualified pension plans, and worker’s compensation benefits. However, several benefits deemed minimal value is not included in taxable wages. Examples include occasional parties, supper money, or even taxi fares for employees who need to work late. In addition, specific company equipment is not taxable.

Fringe benefits are also included in your taxable income. In most cases, approximately 30% of the amount you receive from a job is taxable. Fortunately, there are some ways to reduce this portion. First, you should consider your employer’s policy on fringe benefits.

Current Ctc in Salary?

Current CTC refers to the money invested in you by your current firm (where you are now employed) in terms of pay and allowances as indicated above. Expected CTC is the cost to the firm of you, what you expect when joining a new company or requesting a raise at your current employer.

Cost to Company refers to your present package at the organisation where you are now employed, whereas ECTC refers to your future firm’s expected cost to company.

Cost to Company

CTC is the cost that the company bears to keep the employee. It consists of salaries, incentives, pensions, housing, and travel allowances. This figure varies widely by company. Therefore, employees should consider all the components of the CTC before calculating it. Some of these expenses are tax-free. Others are not.

The total cost to the company is usually calculated annually, but it is still an important factor in employee compensation. It is often used as a benchmark for salary negotiations. While it is a valuable tool, it does not always accurately reflect the actual cost of an employee. In addition, this calculation may exempt some expenses, including employee stock options and overtime payments.

Employees should be aware of their costs before accepting a job offer. In addition to the basic salary, employees receive a Dearness Allowance, house rent allowance, special allowance, leave travel allowance, and performance-linked incentives. The CTC also includes other monetary and non-monetary expenses the company incurs in hiring and retaining an employee. Therefore, it is critical to compare the salary and cost to the company.

The Cost of current CTC is the total compensation an employer spends each year on an employee. The costs can be indirect or direct, and they change every year. However, those expenses will determine how much the employee earns in a year if they are constant.

As the foundation for all other allowances, the basic salary forms a significant portion of the CTC. It can be up to 50% of the total salary.

Basic Salary

The Cost To Company (CTC) refers to the total money a company spends on an employee each year, including salary and benefits. While some companies pay a higher CTC, the CTC is usually a constant amount. Therefore, it differs from the bring-home salary, which an employee brings home every month.

Knowing the components of your CTC is essential if you’re negotiating a salary. It will give you a better idea of how much you’re asking for. It can also give you a starting point for negotiation. But, of course, giving an amount aligned with current salary trends is always best.

In addition to your CTC, you will also receive various allowances. These include HRA, conveyance allowance, leave travel allowance, and medical allowance. Some of these are tax-free, while others depend on your actual expenses. Some of these expenses are billed claims such as mobile and medical allowance, which are paid when you submit bills.

You should also know your tax liability. Generally, taxes eat up a large portion of your pay. It would help to consider this when negotiating your CTC with your employer. Be aware that many companies try to get more employee benefits during the negotiation process. For example, if you’re new to the company, you might get a sign-on bonus of about 10% of your CTC.

A CTC measures how much money a company spends on an employee. In many cases, CTC combines the basic salary and various allowances. A CTC will show the total cost of an employee’s salary before any deductions are made. In some cases, CTC is less than enough to provide a decent take-home salary.

Perquisites

The term “perquisites” is generally used to describe the benefits granted to an employee on top of their basic salary and other allowances. They can be both monetary and non-monetary. For example, employees are often entitled to receive a monthly allowance called “Dearness Allowance” (DA) if their gross salary falls below a certain threshold. The government announces the amount of DA each year in its budget.

While the overall CTC for a given position is usually uniform, it may differ depending on the company’s location or size. Therefore, you may want to visit a job board or research the salary range for the position you’re applying for. Also, consider the experience and skill level of the position. Finally, consider any travel requirements or other benefits. Once you know what the expected CTC is, you can negotiate for it.

Another prerequisite often covered by the CTC allowance is the cost of a broadband Internet connection and phone service. The CTC allowance should also cover the cost of health insurance premiums and dental expenses. The CTC allowance should be calculated accordingly based on the needs of the employee and the employer.

The CTC (current total compensation) comprises the basic salary plus other allowances. These allowances can be fully taxable or partially taxable. Depending on the type of perquisites, they can add up to more than 40% of your monthly salary. For example, a bank may subsidize a loan for an employee, adding the difference between the market rate and the subsidized rate to the CTC. The employee pays no interest on the subsidized rate.

In addition to the CTC, the employee may receive a pension. This can be a lump sum payment or an annual payment. A pension is not considered a prerequisite, but a portion of it is included in the employee’s salary.

Performance Bonus

A performance bonus is a cash payment to a worker to meet a specific goal. Typically, the bonus amount is smaller than the employee’s take-home pay. Although bonuses are an excellent incentive for employees, they should be separate from their regular pay. This way, the bonus will remind the employee of their efforts and drive them to perform better on the job.

The use of performance bonuses has become a common practice in many organizations. The statistics behind them are compelling: giving employees a 1% raise increases the quality of work by 2%. When this increase is coupled with a lump-sum bonus tied to exceptional contributions, the quality of job performance increases by 20%. The benefits are numerous.

Performance bonuses can be difficult to set. Several factors go into determining the level of a performance bonus. The first is the time employees have to work toward achieving their goals. Having a deadline of at least a year is critical. Otherwise, the employee may not work towards achieving their goals.

Another factor to consider is how the bonus is calculated. Some companies give bonuses based on individual results, while others give bonuses to the entire department or team. For example, a technician may earn a bonus based on the number of parts produced, while a sales representative may receive a bonus based on the number of sales.

Performance bonuses are a great way to increase earnings. Performance bonuses are paid out as lump sums or as a percentage of the regular salary. A bonus gives employees an extra incentive to meet or surpass company expectations.

Taxable Components

There are several taxable components in an employee’s salary. These include the basic salary, bonus, leave encashment, pension, internet reimbursements, and gratuities. The amount of each component varies depending on the employer and the industry in which the employee works. Therefore, each component has a separate tax status; understanding them will help you plan your taxes accordingly.

The basic salary is fully taxable. The higher the basic salary, the more tax an employee will have to pay. However, a low basic salary is not a good idea as it puts the employee at risk of falling below minimum wage standards. In addition, non-cash benefits are taxable. These can include company cars, phones, and internet services. Bonuses, which are given to employees as a lump sum, are a taxable component of an employee’s salary. Bonuses are generally based on the employee’s performance or overall company performance.

Other taxable components include health plan contributions, employee contributions to qualified pension plans, and worker’s compensation benefits. However, several benefits deemed minimal value is not included in taxable wages. Examples include occasional parties, supper money, or even taxi fares for employees who need to work late. In addition, specific company equipment is not taxable.

Fringe benefits are also included in your taxable income. In most cases, approximately 30% of the amount you receive from a job is taxable. Fortunately, there are some ways to reduce this portion. First, you should consider your employer’s policy on fringe benefits.